- March 11, 2025

Trump tariffs and trade tensions: Three reasons why India is best placed in Asia to outperform – The Times of India

For long India has been a laggard when it came to export manufactured goods but very strong in exporting services to the world. With the US turning on the heat on its major trading partners from which it imports manufactured goods worth billions, India’s low goods exports to the US could be its saving grace, a report by global financial major Morgan Stanley said on Tuesday.

“Trade tensions will likely remain a drag on Asia’s growth outlook. We highlight the reasons why India is still the best placed in the region against this backdrop – low goods exports, strong services exports and policy support for domestic demand,” a report by Morgan Stanley’s chief Asia Economist Chetan Ahya and three of his team members said.

“Investors remain very skeptical about India’s growth narrative. But we think the reversal of the unwarranted double tightening of fiscal and monetary policies will help drive the recovery,” the report noted.

“(Monetary) easing is hitting full throttle across three fronts – rates, liquidity injection and regulatory easing. Trade tensions will weigh on the region’s trade outlook, but India is less exposed on account of its low goods exports to GDP ratio. (At the same time), the policy support which will turn around its domestic demand outlook will allow India to outperform.”

Also Read | Donald Trump’s tariffs: India may be among least vulnerable Asian economies in trade war with US – but there’s a catch!

The Morgan Stanley report asserts that India demonstrates resilience in economic performance, particularly during global trade deceleration, due to two significant factors.

- Firstly, the nation maintains the region’s lowest ratio of goods exports to GDP.

- Secondly, its services exports exhibit robust defensive characteristics whilst consistently expanding market share, providing a counterbalance to potential trade impacts.

Why did the Indian economy slow down?

Looking back, it is evident that the economic slowdown resulted from an unanticipated concurrent restriction of both fiscal and monetary measures. In the context of India, despite stable macroeconomic indicators showing no warning signs, the implementation of stringent fiscal and monetary controls led to diminished growth rates.

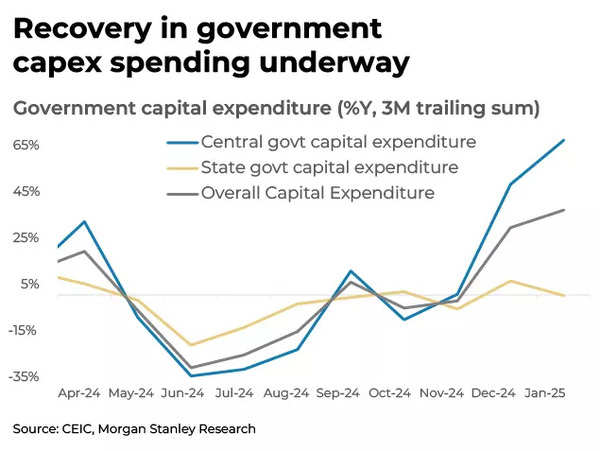

Government spending – which accounts for 28% of GDP – contracted by -6%Y at the trough in Jul-24 on a three-month trailing basis amid elections, and then recovered at a slower-than-expected pace post-elections, especially on the capital expenditure front (which averaged -12% in May-Nov-24 but has now recovered to 37%Y 3MMA in Jan-25). Monetary policy was tightened on all three fronts of policy rates, liquidity and regulatory measures, says the report.

What’s the road to economic recovery?

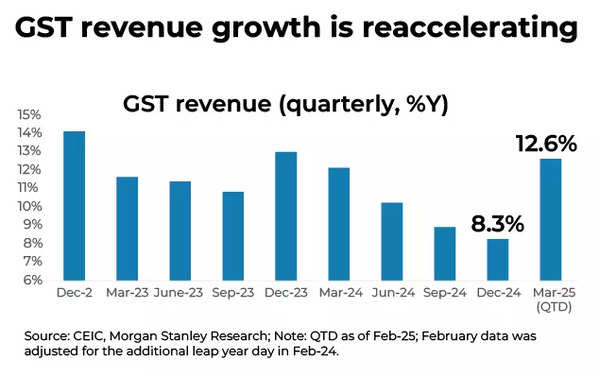

Recovery will continue to firm over the coming months. Green shoots are already emerging in recent data. For example, goods and services tax (GST) revenue – has accelerated to an average of 10.7% in Jan-Feb 2025.

GST revenue is reaccelerating

According to the Morgan Stanley report, recovery will be driven by:

1) Sustained momentum in government capex spending: Central government capital expenditure growth has accelerated markedly in December and January. In the F2026 budget plan, capital expenditure is estimated to grow at 10.1%Y, indicating continued support for public capex.

Recovery in government capex spending underway

2) Triple easing on monetary policy: Morgan Stanley expects policy easing across policy rates, liquidity and regulatory front to support the growth recovery. It expects a second 25bps rate cut at the April meeting with risks of more rate cuts if the growth recovery plays out more slowly than it expects. RBI is expected to continue to manage liquidity conditions proactively, especially in the context of the seasonal rise in liquidity deficit towards financial year end (March).

Also Read | How will Elon Musk-led DOGE’s slashing of federal spending impact Indian IT companies?

To the extent that RBI has begun easing regulatory tightening on non-bank financial companies (NBFCs) – as evident in the recent rollback of the 25ppt increase in risk weights for bank credit to NBFCs – Morgan Stanley believes this would help improve liquidity accessibility for NBFC lenders and end borrowers.

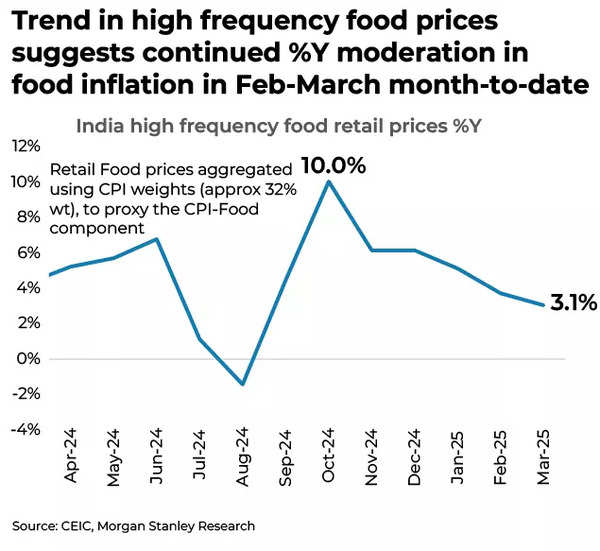

3) Moderation in food inflation lifting real household incomes: With food inflation having since moderated from its October peak of 10.9%Y to 6%Y in January, headline CPI has taken a step down to a five-month low of 4.3%Y. With the trend in high frequency food prices indicating continued %Y moderation in February and March month-to-date, Morgan Stanley expects the disinflation trend at the headline CPI level to continue.

Food inflation trending downwards

4) Improvement in services exports: Morgan Stanley believes India’s services exports should remain relatively healthy. During times when the global trade environment turns down, goods exports may contract but services generally do not. The strength in services exports should also reflect in a pickup in urban jobs growth and hence private consumption with a lag.

Can India avoid tariffs, reach a trade deal with the US?

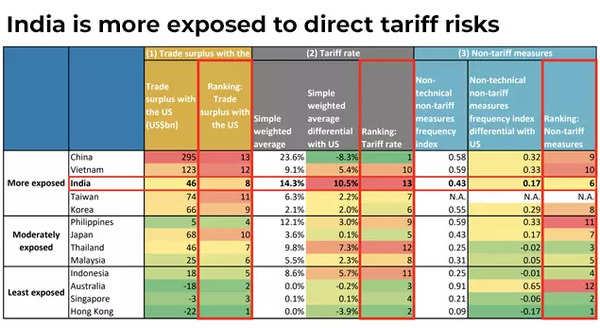

India faces significant exposure to potential tariff escalation within Asia, particularly concerning reciprocal tariffs, due to its high import tariff rates, substantial non-tariff barriers, and considerable trade surplus with the US. The precise impact remains uncertain, as the US administration has not yet provided detailed clarification regarding the implementation of reciprocal tariffs, says the Morgan Stanley report.

India more exposed to direct tariff risks

India’s vulnerability extends to its pharmaceutical exports, which constitute 2.8% of total exports and 0.3% of GDP, as these products have been identified by President Trump as potential targets for tariff implementation.

Whilst a trade agreement between India and the US appears achievable by fall 2025, the negotiation process is likely to be complex and time-consuming due to various bilateral trade complications.

“While India is exposed to direct tariff risks, we have consistently highlighted that the bigger effect on growth from tariffs likely comes via the indirect transmission channel of weaker corporate confidence from heightened policy uncertainty and the spillovers to capex and trade cycle. From this perspective, India’s low goods trade orientation and ability to generate domestic demand offset mean it is among the least exposed economies within the region from an indirect effect standpoint,” says the report.

Also Read | Turnaround from importer to exporter! India now shipping Apple product components to China & Vietnam