- August 22, 2025

VC stakes at risk, startups look at rejigging biz models – Times of India

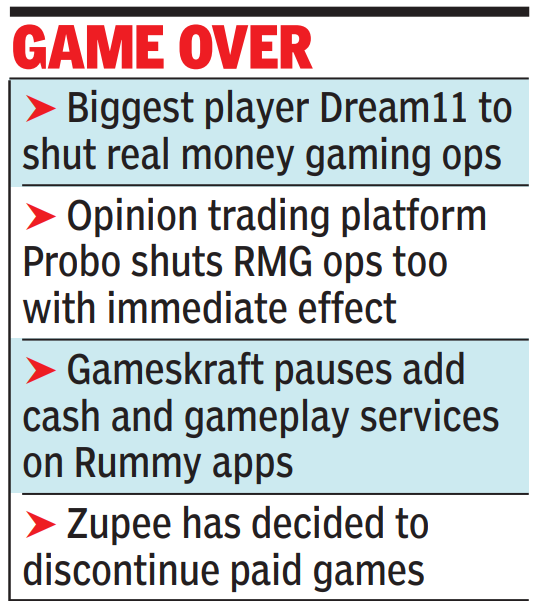

MUMBAI: For venture capital (VC) investors who have infused several million dollars into gaming startups, the sweeping ban on online real-money gaming (RMG) has put their investments at risk. Some investments could be written off and valuation markdowns look certain. “The real money gaming segment faces complete elimination, forcing investors to reassess their entire portfolios in the space. Investors may consider marking down valuations across the gaming sector,” Aaron Kamath, leader, tech and digital media practice at Nishith Desai Associates told TOI. Initially, most investors will give companies room to adapt but if that proves unviable, write-downs and exits will be inevitable, said Pearl Agarwal, founder and managing partner at Eximius Ventures.Peak XV Partners (formerly Sequoia India and Southeast Asia), Kalaari Capital, RTP Global and Alpha Wave Global are among investors who have backed RMG firms. Gaming companies like Nazara Technologies also have picked up some stakes in RMG startups. Nitish Mittersain, CEO at Nazara whose stock crashed post the development said that it was too early to take a call on writing off its investment in PokerBaazi but the firm will do “whatever accounting standards apply.” Between 2020-2024, investors have collectively pumped in $696 million into RMG startups, data sourced from Tracxn showed.

Legal challenges onThe ban which is a step closer to being implemented after Parliament cleared the Online Gaming Bill, has set off a series of legal consultations and deliberations in the broader VC and startup ecosystem. In fact, legal challenges are already underway with industry bodies representing major platforms preparing coordinated constitutional challenges before the judiciary, arguing “the blanket ban is arbitrary and disproportionate”, Kamath said.Considering the Bill has flagged that online gaming services are linked to serious unlawful activities such as financing of terrorism and posing threat to national security, it will be tricky to see how the Supreme Court views this development, said Surbhi Kejriwal, partner at law firm Khaitan & Co.Investor sentiment hitThe broader investment has taken a hit with some experts saying that the move doesn’t align with the govt’s push for ease of doing business. “Sudden blanket bans don’t inspire a lot of confidence amongst global technology investors who are otherwise bullish on India but struggle to factor in regulatory risk in their investments….ironically, we also have a $30 billion lottery market, a state subject,” said Nitin Sharma, partner at Singapore-based VC firm Antler India. It unsettles domestic and international investors to have the policy changed on the fly, added Ranjeet Shetye, venture partner at YourNest. Such a drastic shift signals to investors that the Govt can arbitrarily dismantle a thriving sector, creating significant regulatory risk, said Probir Roy Chowdhury, partner at JSA Advocates & Solicitors.Models to be reworkedRMG startups will have to pivot to e-sports and social gaming, relocating operations to jurisdictions with clearer regulatory frameworks, said experts. “Some large-scale gaming companies are considering diversifying and exploring alternative revenue channels such as offline or casino businesses in permitted territories,” said Kejriwal.