- December 2, 2025

Trump sanctions: India’s crude imports from Russia at 5-month high – can it continue? – The Times of India

Donald Trump’s sanctions on Rosneft and Lukoil – two of Russia’s major crude firms – may result in India’s imports of oil from Moscow dropping – but will this shift be permanent? Analysts expect India to continue procuring Russian crude through non-sanctioned entities and even indirect and less transparent routes. In fact, Russian grade imports to India in November are set to reach a five-month peak, primarily due to increased purchases before the 21 November sanctions deadline. India’s crude oil imports from Russia have emerged as a major point of contention between New Delhi and Washington. The Trump administration’s 50% tariffs on India – one of the highest by the US – consist of 25% penal tariffs for India’s crude oil imports from Russia. The Trump government has accused India of indirectly funding Russia’s war against Ukraine through its crude oil trade.India has maintained its sovereignty in deciding its trade partners and procure energy through the economically advantageous channels. However, the Trump administration in October this year sanctioned two of the biggest Russian oil firms – major suppliers of crude to Indian refiners. For Trump, the sanctions may finally have the desired impact of Indian refiners reducing their crude oil purchases.How have the sanctions been playing out? Has India reduced its crude oil trade with Russia substantially? And what are India’s alternatives?

India-Russia crude oil trade: Important numbers

* India became the leading purchaser of Russian crude oil at discounted rates after Western nations boycotted Moscow in response to its invasion of Ukraine in February 2022. India, which traditionally sourced oil from Middle Eastern nations, substantially increased its Russian oil purchases as sanctions and diminished European demand made these barrels available at considerable discounts, raising Russia’s share from less than 1 per cent to approximately 40 per cent of total crude imports. *According to Kpler, a global real-time data and analytics provider, Russia has maintained its position as India’s primary supplier in November, providing over one-third of all crude oil imports.* This situation is likely to shift following the implementation of US sanctions on Rosneft, Lukoil and their majority-owned subsidiaries from November 21, effectively categorising crude associated with these companies as a “sanctioned molecule”.* These sanctions have prompted several companies, including Reliance Industries, Hindustan Petroleum Corporation Ltd (HPCL), HPCL-Mittal Energy Ltd and Mangalore Refinery and Petrochemicals Ltd to temporarily cease imports. Nayara Energy, supported by Rosneft, remains the sole exception, as it heavily relies on Russian crude after European Union sanctions effectively terminated supplies from other global sources. * Russian crude arrivals have maintained robust levels, with an average of approximately 1.8 mbpd, constituting over 35% of India’s total crude imports. Prior to November 21, import levels were higher at 1.9-2.0 mbpd as purchasers expedited shipments before the deadline, following which volumes have decreased. “It looks like refiners stocked up on crude ahead of the sanctions, planning to process it once the rules were in force,” says Sumit Ritolia, Lead Research Analyst, Refining and Modelling at Kpler.A notable decline in Russia’s exports to India has emerged since the OFAC sanctions announced on October 23, current shipping patterns and voyage data suggest. “We expect December arrivals to be in the range of 1.0 mbpd. This aligns with our earlier view that, in the short term, Russian flows could ease toward ~800 kbd before stabilising,” says Ritolia.Several factors contribute to November’s robust performance:* Expedited arrivals prior to 21 November deadline, with refiners enhancing scheduling efficiency and vessel turnaround times, especially for Rosneft- and Lukoil-associated shipments.* Strong domestic fuel requirements and intensive refinery operations during Q4, as Russian supplies remained the most cost-effective additional feedstock.* Enhanced performance at Nayara, operating predominantly on Russian grades, has been noticeable since September. Crude imports attained approximately 400 kbd through November, whilst refinery operations averaged 380-400 kbd in November, showing an increase of 20-25 kbd compared to October.

Will India stop buying Russian crude oil?

Refiners are implementing strategic adjustments for the intermediate future. These include engaging with non-sanctioned Russian entities, utilising less transparent trading channels, and increasing procurement from the Middle East, West Africa, and the Americas, says Kpler.“On the Russian side, the response has been highly adaptive, involving STS transfers near Mumbai, mid-voyage diversions, and more complex logistics to keep barrels moving and increase discounts. As long as broader secondary sanctions aren’t applied, India is likely to continue importing Russian crude—just through more indirect and less transparent routes,” says Ritolia.Concerning market sentiment, oil refiners point out that sanctions apply only to specific entities, not Russian oil in general. They maintain that purchases can proceed when dealing with compliant, non-sanctioned suppliers. The appealing price discounts continue to drive sustained demand.Kpler points out that the workaround is simple and already well-tested: continue buying Russian crude, but through intermediaries. If the barrels are supplied via third-party trading entities, entities that can credibly show they are not Rosneft/Lukoil, then refiners can keep accessing discounted supply while limiting the appearance of sanctionable contact, says Kpler. “This is a trend that has already started with new sellers emerging such as Tatneft, RusExport, MorExport or Alghaf Marine DMCC. However, November numbers may continue to adjust downward / upward as more destination-day and port-call data becomes available,” says Ritolia.

Impact of US sanctions

Importantly, Ritolia notes that while India’s oil imports from Russia are likely to decrease after sanctions, the decline is most likely to be temporary, allowing the supply chain to reorganise itself. “Unless more expansive secondary sanctions are introduced, India will continue to buy from a non-sanctioned supplier of Russian oil. The reasons are multiple: the geopolitical and economic dimensions are both essential. Political leaders will not want to be seen as bending down to US sanctions. At the same time, Russian barrels remain highly cost-competitive, and workarounds to maintain flows are likely to emerge. In particular, buyers may increasingly pivot to non-sanctioned Russian entities and opaque trading channels,” Sumit Ritolia says.

India’s procurement of US crude & other alternatives

India’s crude imports from the United States reached a peak of 568 kbd in October, the highest level since 2022, as per Kpler data. Although these imports decreased to approximately 450 kbd in November, they remained significantly above the year-to-date average of ~300 kbd. “These flows were almost certainly contracted before the recent US sanctions on Rosneft and Lukoil, given the 45–55-day voyage time, meaning the spike was not sanctions-driven but instead part of India’s ongoing effort to diversify its crude slate and strengthen energy security,” says Kpler.The primary drivers for this increase were economic factors, including a favourable arbitrage opportunity, an expanded Brent-WTI differential, and reduced Chinese demand, which made WTI Midland cost-effective on a delivered basis. However, the November decline indicates the limitations of this opportunity. Current export patterns suggest that December crude imports will likely decrease to 300-350 kbd, with subsequent levels expected to stabilise around ~300 kbd.The potential for substantial growth remains limited due to extended voyage times, increased freight costs, and WTI’s lighter, naphtha-rich composition.

Alternatives to Russian crude

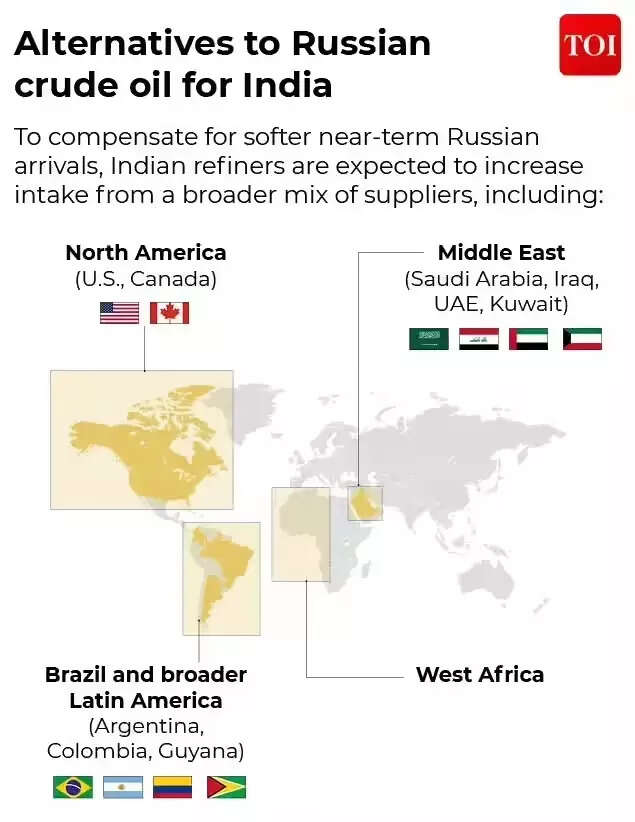

“Even so, the elevated US presence in India’s crude basket underscores the deepening strategic energy alignment between the two countries and supports India’s broader diversification strategy balancing security, economics, and geopolitics,” notes Kpler’s Ritolia.Indian refiners’ technical sophistication allows them to process various crude grades without operational challenges. The primary impact of reducing Russian volumes would be financial rather than technical. To address the temporary reduction in Russian oil supplies, Indian refineries are planning to expand their procurement from diverse sources including:

- Middle East (Saudi Arabia, Iraq, UAE, Kuwait)

- Brazil and broader Latin America (Argentina, Colombia, Guyana)

- West Africa

- North America (US, Canada)