- February 1, 2026

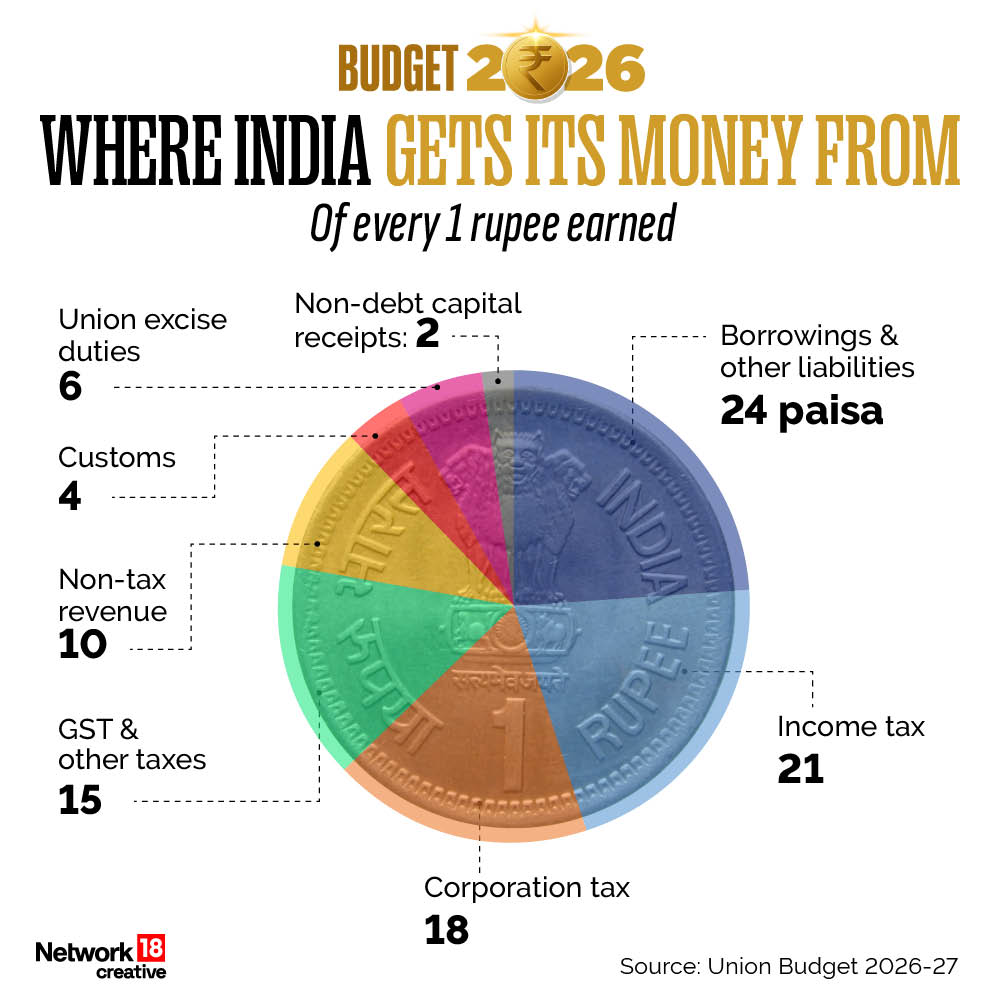

Budget 2026: Taxes Account For 64 Paise Of Every Rupee Earned By Govt

Last Updated:

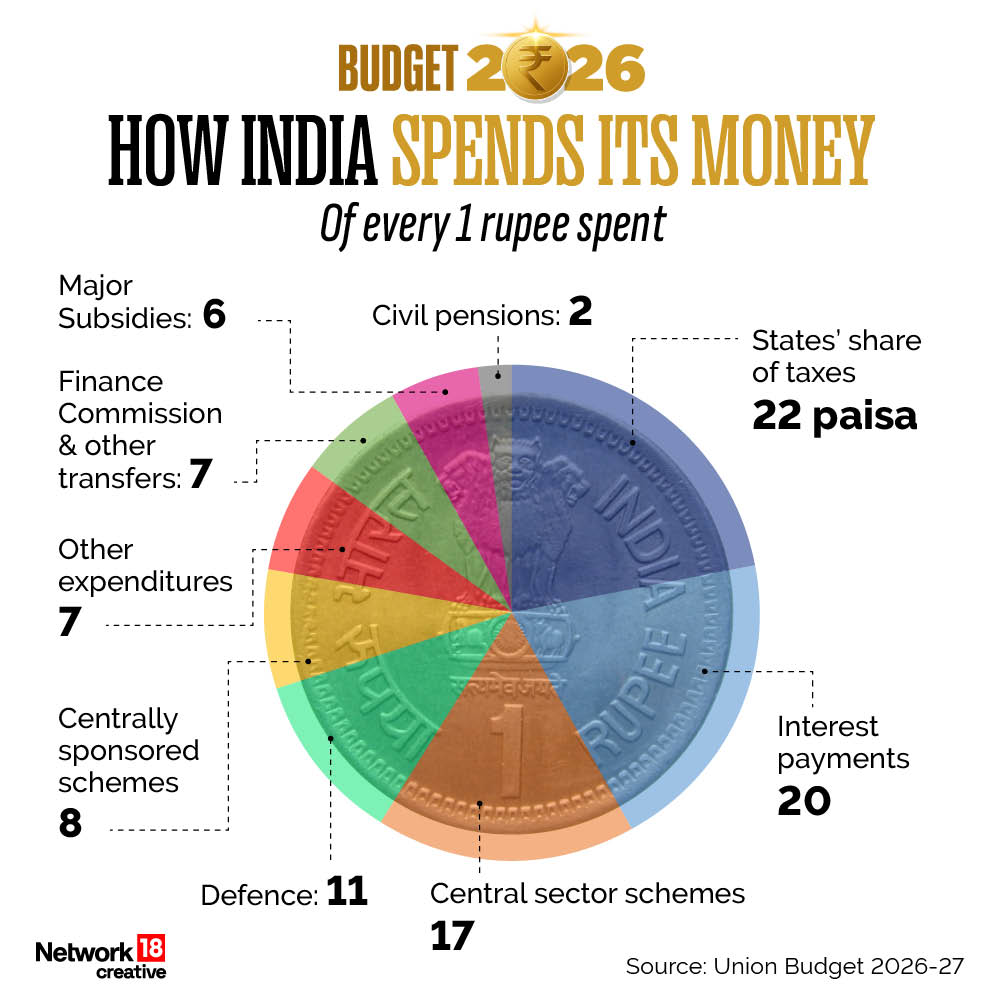

Budget 2026: On the expenditure side, states’ share of taxes and duties takes the biggest slice at 22 paise, while interest payments account for 20 paise.

FM Nirmala Sitharaman presents the Union Budget 2026.

For every rupee that flows into the government’s coffers, nearly two-thirds (64 paise) will come from a combination of direct and indirect taxes, according to the Union Budget 2026-27 documents.

Borrowings and other liabilities will account for 24 paise of every rupee of receipts, while non-tax revenue, including disinvestment proceeds, will contribute 10 paise. Non-debt capital receipts will make up the remaining 2 paise.

Among tax revenues, income tax will generate the largest share at 21 paise per rupee, followed by corporation tax at 18 paise and goods and services tax (GST) at 15 paise. Excise duty and customs duty are expected to add 6 paise and 4 paise, respectively.

Expenditure Side

The Budget documents also provide a fractional break-up of how each rupee is spent. On the expenditure side, states’ share of taxes and duties will take the biggest slice at 22 paise, while interest payments will account for 20 paise.

Defence expenditure is pegged at 11 paise per rupee. Central sector schemes will receive 17 paise, and centrally sponsored schemes 8 paise. Transfers under the Finance Commission and other heads will account for 7 paise.

Subsidies are estimated at 6 paise per rupee, while pensions will take 2 paise. The remaining 7 paise will be spent on other expenditures.

February 01, 2026, 17:26 IST

Read More