- January 13, 2023

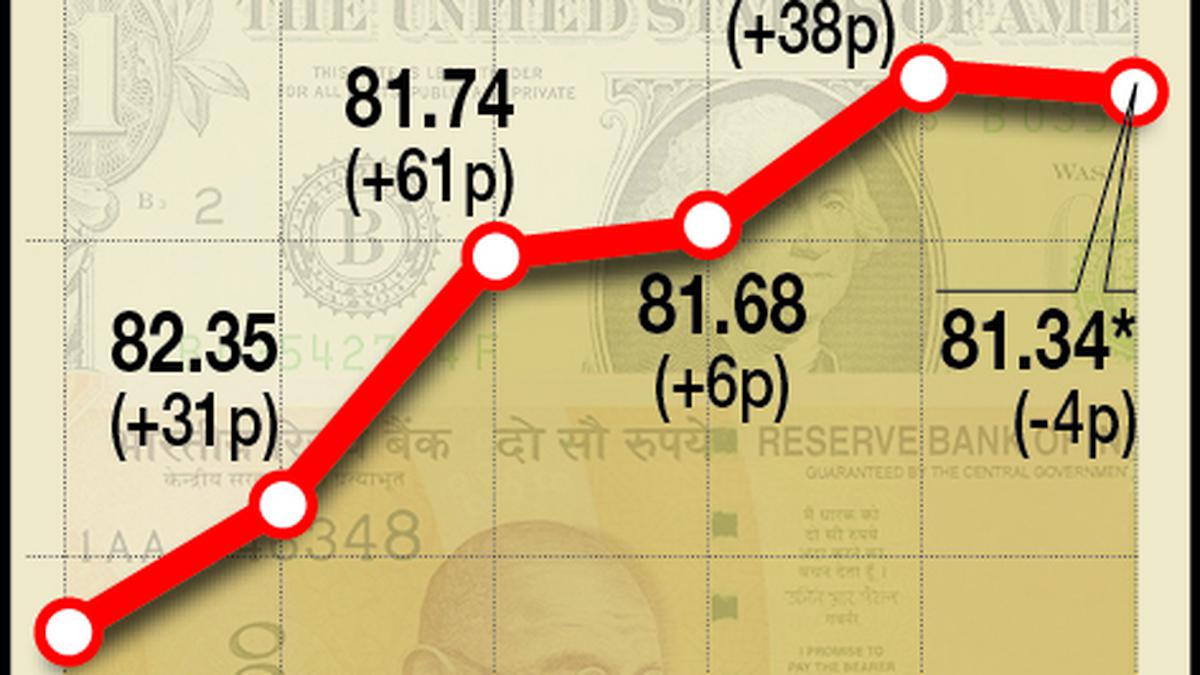

Rupee falls 4 paise to close at 81.34 against U.S. dollar

The rupee depreciated by 4 paise to close at 81.34 (provisional) against the U.S. dollar on Friday, tracking a rebound in crude oil prices and sustained foreign fund outflows.

Forex traders said positive macroeconomic data and broad weakness in the American currency supported the rupee and contained the depreciation bias.

At the interbank foreign exchange market, the rupee opened on a weak note at 81.32 against the greenback, but lost ground and fell to an intra-day low of 81.45.

The domestic currency finally settled at 81.34, down 4 paise over its previous close of 81.30.

The dollar index, which gauges the greenback’s strength against a basket of six currencies, was trading 0.06% lower at 102.18.

Global oil benchmark Brent crude futures rose 0.42% to $84.38 per barrel.

According to Dilip Parmar, Research Analyst, HDFC Securities, the Indian rupee registered the biggest weekly gains after November 11 on the back of better-than-expected economic data and broad-based weakness in the dollar.

Risk assets globally rallied and the safe-haven US dollar slumped after the US inflation readings came lower than expected, Mr. Parmar said.

“The near-term outlook for USDINR remains bearish as long as it trades below 82.10 while on the downside, one can see 81.10 and 80.70,” Mr. Parmar added.

The 30-share BSE Sensex ended 303.15 points or 0.51% higher at 60,261.18, while the broader NSE Nifty advanced 98.40 points or 0.55% to 17,956.60.

Foreign institutional investors (FIIs) turned net sellers in the capital markets on Thursday as they offloaded shares worth ₹1,662.63 crore, according to exchange data.

Meanwhile, on the domestic macroeconomic front, India’s industrial production growth rose to a five-month high of 7.1% in November on the back of better showing by manufacturing, according to official data released on Thursday.

Retail inflation declined to a one-year low of 5.72% in December 2022 mainly due to cooling of vegetable prices, according to the data.

Experts believe, with the Consumer Price Index (CPI) remaining below 6% for the second month in a row, the Reserve Bank has some room to pause interest rate hike which has been going on since May last year.