- April 5, 2024

Sensex gains marginally to scale new peak after RBI policy decision

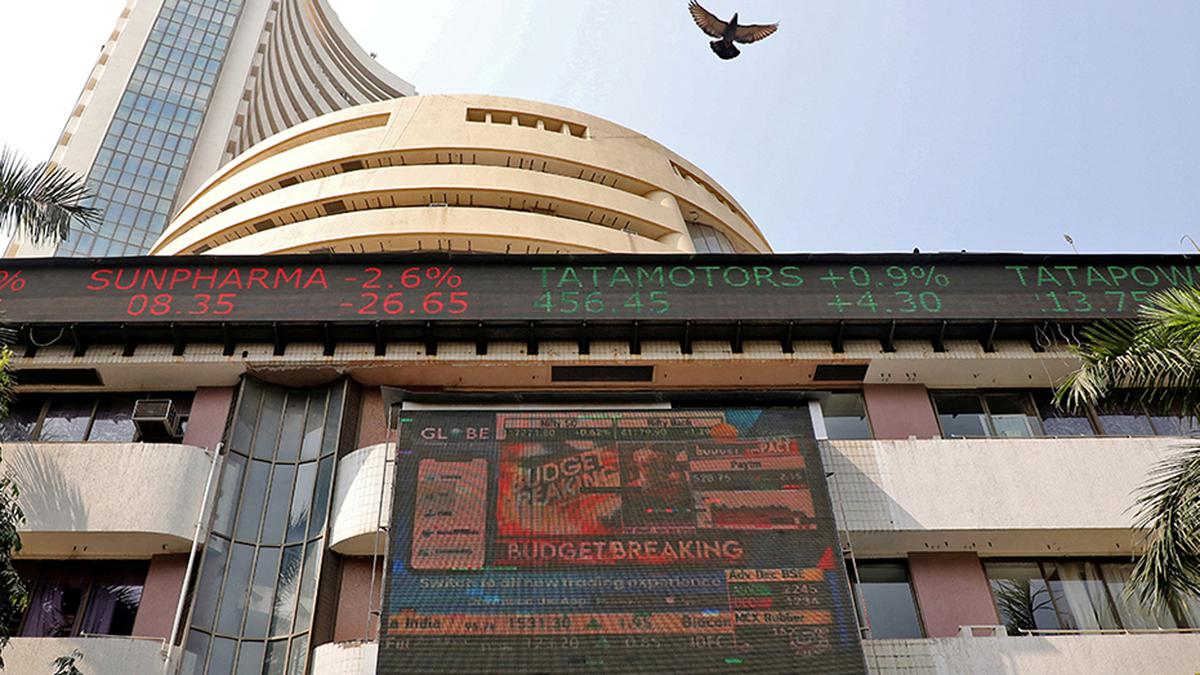

The Bombay Stock Exchange (BSE) building in Mumbai. File

| Photo Credit: REUTERS

Equity benchmark index Sensex registered marginal gains to hit fresh lifetime high on April 05 after the Reserve Bank maintained the status quo on key interest rates amid a negative trend in global markets.

The six-member rate-setting panel of the Reserve Bank of India (RBI) on April 05 kept the benchmark interest rates unchanged at 6.5% for the seventh time in a row. It also expressed concerns over food inflation given IMD’s prediction of above-normal maximum temperatures during April-June.

The 30-share BSE Sensex inched up 20.59 points or 0.03% to settle at a fresh record of 74,248.22. The index oscillated between the intra-day peak of 74,361.11 and the low of 73,946.92.

The broader NSE Nifty ended with a marginal loss of 0.95 points at 22,513.70. As many as 28 components of the 50-share benchmark ended in the red.

“Although the RBI policy meeting unfolded as anticipated, concerns over food inflation and warnings of a heat wave tampered sentiment,” said Vinod Nair, Head of Research, Geojit Financial Services.

Among the Sensex constituents, 18 stocks closed in negative with UltraTech Cement, L&T, Bharti Airtel, Bajaj Finance and Tech Mahindra being major laggards.

Other heavyweights like Asian Paints, Maruti, Titan and JSW Steel also saw heavy selling.

In contrast, Kotak Mahindra Bank, Bajaj Finserve, HDFC Bank, ITC and SBI bucked the trend and ended the session with a gain of up to 2.09%.

BSE largecap gained 0.15%, while midcap and smallcap indices rose 0.50%.

Global oil benchmark Brent crude advanced 0.11% to $90.75 a barrel.

Asian markets were lower, with Japan’s Nikkei 225 losing 1.96% and Hang Seng of Hong Kong declining 0.01%. South Koran index Kospi fell 1.01% .

European markets were trading in the red. Germany’s DAX and London’s FTSE 100 lost 1.57% and 0.90%, respectively, while CAC40 of France went down by 1.36%.

The U.S. markets closed largely lower in the overnight trade on April 04.

“The global sentiment was dampened by the rise in oil prices and tensions in the Middle East. Investors remain attentive to upcoming US non-farm payroll and unemployment data, seeking clarity on the Federal Reserve’s future rate path,” Mr. Nair said.

Foreign Institutional Investors (FIIs) offloaded equities worth ₹1,136.47 crore on April 04, according to exchange data.

On Thursday, the BSE benchmark Sensex surged 350.81 points or 0.47% to settle at its lifetime high of 74,227.63. The NSE Nifty also hit its fresh peak of 22,514.65, gaining 80 points or 0.36%.