- November 9, 2024

‘Domestic savers to offset foreign investor exodus’: experts

Although Dalal Street may remain volatile in the short term thanks to FII exits, it will stabilise in the medium term, experts said

| Photo Credit: Paul Noronha

October’s record pullback from Indian markets by foreign institutional and portfolio investors (FIIs and FPIs) may not deter inflows from domestic investors into Indian equity markets as they remain confident of the returns in the medium-term, according to market analysts.

Although Dalal Street may remain volatile in the short term thanks to FII exits, it will stabilise in the medium term, they said.

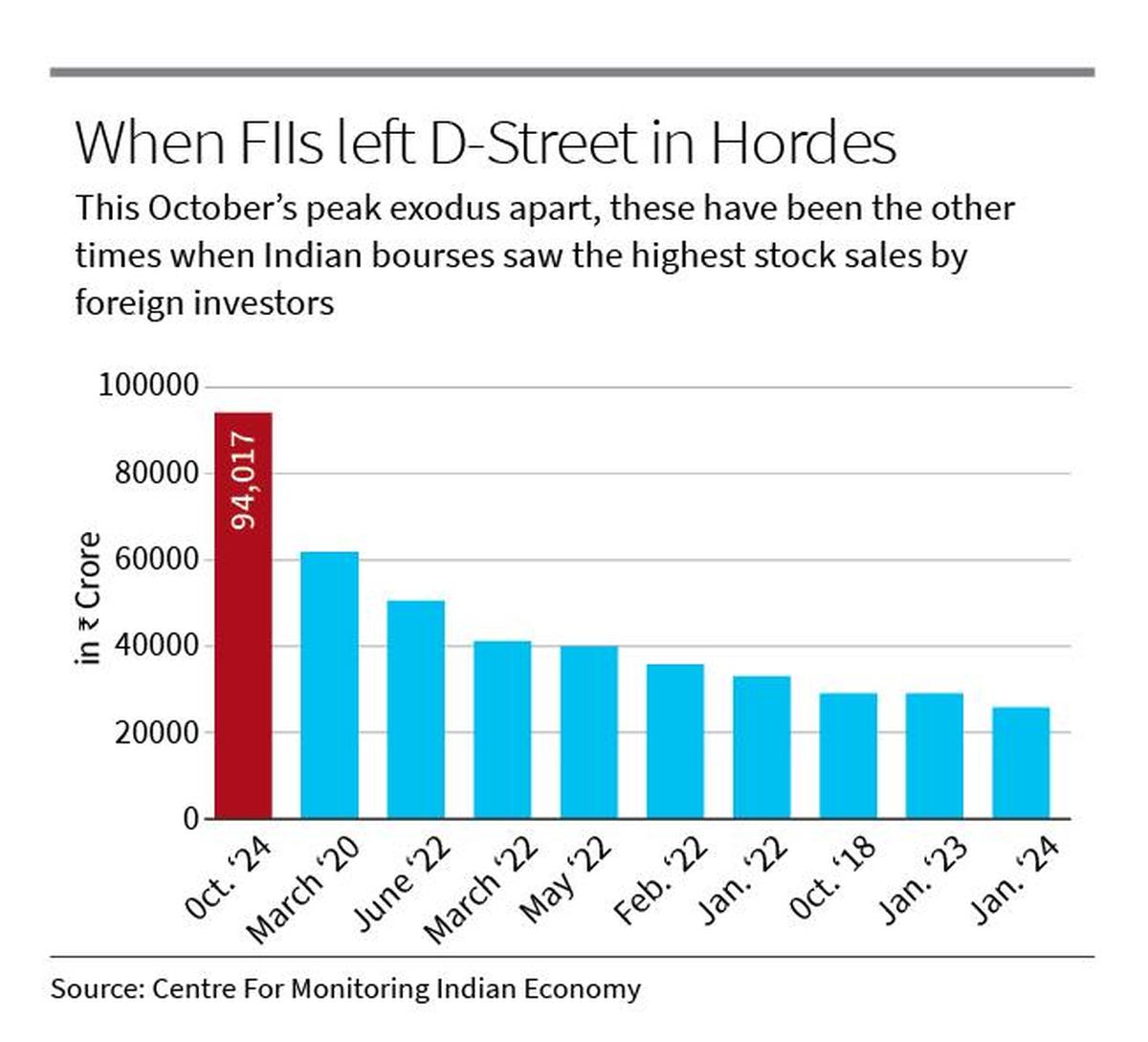

FIIs sold the most Indian equities in October, making it the worst month in the Indian equity markets for foreign investors, according to data from Centre for Monitoring Indian Economy (CMIE).

In October alone, FIIs sold a net ₹94,000 crore in equities, reversing the ₹57,000 crore inflows received from them in the previous month.

“Ordinary investors should be prepared for more volatility in the near term. I advise caution, especially if FII outflows persist” said Trivesh D, chief operating officer of Tradejini, a Bengaluru-based zero-brokerage firm.

While FIIs are more opportunistic, looking for value wherever it can be found, domestic institutional investors (DIIs) exhibit confidence in the Indian markets, he added.

According to experts, the steady DII buying kept the market buoyant despite the FII outflows. “The structural nature of these investments, which include retirement assets, will not lead to DII selling in the medium term despite a short-term volatility,” said Atul Parakh, CEO, Bigul, a Navi Mumbai-based brokerage firm.

DIIs are also looking at the current corrections as an opportunity to buy quality stocks at a cheaper price, Mr. Trivesh added.

Both domestic and foreign events have a bearing on the FII selling, said Mr. Trivesh. “Global factors are the stronger determinants of this FII sell-off. For instance, China’s recent stimulus package — including a reduced reserve requirement, lower mortgage rates, and direct borrowing access for institutional investors from the People’s Bank of China — has played a key role,” he said.

The senior Tradejini executive also pointed to the rising U.S. bond yields that presented an attractive investment opportunity for FIIs, besides the China factor. Domestically, lukewarm earnings and high valuations have contributed to the selloff, but that is not as significant as the global factors, he added. Donald Trump’s re-election as U.S. President has also introduced a degree of uncertainty to all markets.

A sector-wise analysis of FII flows also signals weakening trends. Seven of 24 sectors witnessed net FII selling in September, including construction materials, automobiles and auto components, consumer services, information technology, oil and gas and consumable fuels, and textiles. Stocks of firms into diversified investments, also saw net FII/FPI selling in September. The opposite trend was noted in the DII segment, with domestic investors being net buyers in the stock market. This suggests a divergence in sentiments of the two broad investor categories.

The DIIs bought a little more than₹1 lakh crore of Indian equities in October, covering for the FII sales. DII sales too shows a nuanced trend where NRIs(Non-Resident Indians)and client investors were net sellers, but proprietary traders were the only net buyers.

Client investor category consists of high net worth individuals (HNI) with liquid assets exceeding ₹5 crore, without taking their primary residence into account, and retail investors through portfolio managers. Proprietary traders include treasury operations of domestic financial institutions.

“The recent market activity shows significant divergence between FII and DII positions in October, driven by distinct factors” said Mr. Parakh. “The DII buying is predominantly led by mutual funds through flows from systematic investment plans averaging ₹15,000 crore a month, insurance companies, and pension funds like the EPFO and the National Pension System,” Mr. Parakh noted.

Published – November 09, 2024 07:54 pm IST