- August 24, 2024

Explained | What Is Unified Pension Scheme? How Is It Different from NPS? – News18

Union Cabinet approved the Unified Pension Scheme.

After extensive consultations and discussions, including with the JCM (Joint Consultative Mechanism), the committee has recommended the Unified Pension Scheme. Today, the Union Cabinet has approved the scheme.

Unifed Pension Scheme Vs NPS: The Union Cabinet on Saturday approved the Unified Pension Scheme (UPS), for an assured pension post-retirement. The UPS will be implemented from April 1, 2025. The move comes after the long-pending demand of the central government employees to reform the new pension scheme (NPS).

Briefing the media on Cabinet decisions, Information & Broadcasting Minister Ashwini Vaishnaw said, “There have been demands from government employees to reform NPS (New Pension Scheme)… PM Narendra Modi formed a committee in April 2023 on this under T V Somanathan (who was then finance secretary)… After extensive consultations and discussions, including with the JCM (Joint Consultative Mechanism), the committee has recommended the Unified Pension Scheme. Today, the Union Cabinet has approved the scheme.”

What Is Unified Pension Scheme?

It is the latest pension scheme for government employees.

Under the UPS, there will be a provision of a fixed assured pension, unlike the New Pension Scheme (NPS) which does not promise a fixed pension amount.

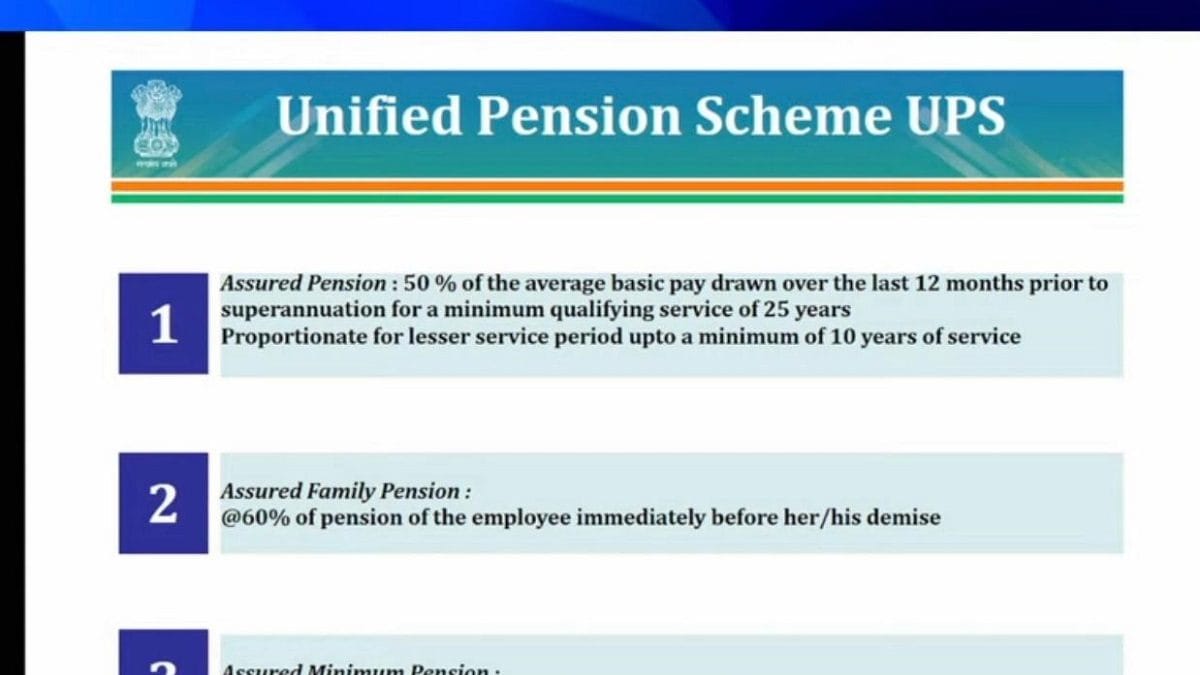

Assured Pension: Under the UPS, the fixed pension will be 50 per cent of the average basic pay drawn over the last 12 months prior to superannuation for a minimum qualifying of 25 years proportionate for a lesser service period up to a minimum of 10 years of service.

Fixed Family Pension: It will also have an assured family pension, which is 60 per cent of the employee’s basic pay. It will be given immediately in case of demise of the employee.

Assured Minimum Pension: In the case of superannuation after a minimum 10 years of service, the UPS has a provision of an assured minimum pension of Rs 10,000 per month.

Inflation Indexation: There is a provision of indexation on assured pension, on assured family pension and assured minimum pension.

Gratuity: Lump-sum payment at superannuation in addition to gratuity. It will be 1/10th of the monthly emolument (pay + dearness allowance) as on the date of superannuation for every completed six months of service.

Who Can Join UPS?

“Central government employees will have a right to decide to stay in the New Pension Scheme (NPS) or join the Unified Pension Scheme (UPS),” said Vaishnaw.

During the media briefing on Saturday, Cabinet Secretary Designate T V Somanathan also said, “This will also apply to all those who have already retired under the NPS from 2004 onwards. Though the new scheme will take effect from April 1, 2025, everybody who has retired under NPS from the time of its inception and also including those retiring till March 31, 2025, will also be eligible for all these five benefits of the UPS. They will get arrears of the past after adjusting whatever they have withdrawn.”

What Is National Pension System or New Pension Scheme or NPS?

Introduced in January 2004, the National Pension Scheme (NPS) originally served as a government-sponsored retirement plan exclusively for government employees. Later, in 2009, it was expanded to encompass all other sectors.

The NPS is governed jointly by the government and the Pension Fund Regulatory and Development Authority (PFRDA) and is designed as a long-term, voluntary investment program tailored for retirement.

The NPS assures a pension, with the potential for substantial investment gains.

Upon retirement, a subscriber has the option to withdraw a portion of their accumulated corpus, while the remaining amount is disbursed as a monthly income. This strategy provides a steady stream of income after retirement.

The NPS is divided into two tiers: Tier 1 accounts and Tier 2 accounts. Individuals who choose a Tier 1 account can withdraw cash only after they retire, but Tier 2 accounts allow for early withdrawals.

Under Section 80 CCD of the Income Tax Act, investing in the NPS provides tax advantages of up to Rs 1.5 lakh. Withdrawing 60 per cent of the NPS corpus makes it tax-free. This makes it an appealing option for retirement planning since it provides the possibility of a lump sum payoff.