- November 20, 2025

Marvel Lost ‘Spider-Man’, ‘X-Men’ And Nearly Everything To Debt. Then One Idea Saved The Company

Last Updated:

Marvel’s trajectory, from near collapse in the 1990s to global dominance in the 2010s and beyond, is one of the most remarkable turnarounds in corporate history

In 2009, Disney acquired Marvel for $4 billion, a deal widely considered one of the most successful entertainment investments ever made.

In the late 1980s and early 1990s, Marvel Comics stood at the peak of the superhero landscape, riding a wave of unprecedented popularity. What began as a modest comic-book publisher had grown into the dominant force in the US market, capturing an estimated 70% share by 1993. But behind the booming sales and iconic characters, a financial crisis was quietly building.

During this period, comics transformed from collectibles into speculative investments. Fans and investors alike bought stacks of newly released titles, sometimes dozens of copies each, believing they would one day sell for massive profits. Publishers responded with extravagant print runs, variant covers, and flashy marketing. In 1991, Marvel printed millions of copies of X-Force #1, a symbol of the industry’s excess.

Ronald Perelman, a billionaire investor, purchased Marvel in 1989 for $82.5 million. He aggressively expanded the company, taking it public in 1991 and spending heavily on acquisitions such as Fleer (1992), Panini (1993), and Heroes World Distribution (1994). Marvel’s stock soared from $12 to nearly $36 under his leadership, and revenue topped $400 million.

But writer Neil Gaiman warned in 1993 that the booming market resembled “Tulip Mania”, a bubble destined to collapse. His prediction quickly proved correct.

Collapse of the Comic Market

By 1993, speculative buying fizzled. Investors dumped their comics, sales plunged by nearly 70%, and the market cratered. Marvel’s revenue fell sharply, from about $300 million in 1993 to under $100 million by 1996. Its costly subsidiaries, including Fleer and Panini, were pushed to the brink.

Marvel attempted to raise prices to compensate, bumping the cost of a single comic from 75 cents to nearly $2. But fans complained about declining story quality and overstuffed crossover events such as the infamous “Clone Saga”. Retailers suffered as distribution costs soared, especially after Marvel’s experiment with Heroes World failed disastrously. About 4,000 comic shops shuttered by the decade’s end.

Debt piled up, reaching between $700 million and $1 billion. To stay afloat, Marvel sold movie rights to some of its most valuable characters, including Spider-Man, the X-Men, and the Fantastic Four. Investor confidence evaporated. A bitter feud erupted between Perelman and financier Carl Icahn, lawsuits mounted, and Marvel’s stock collapsed from $35 to just $2. By 1996, the company was in bankruptcy court, its future in doubt.

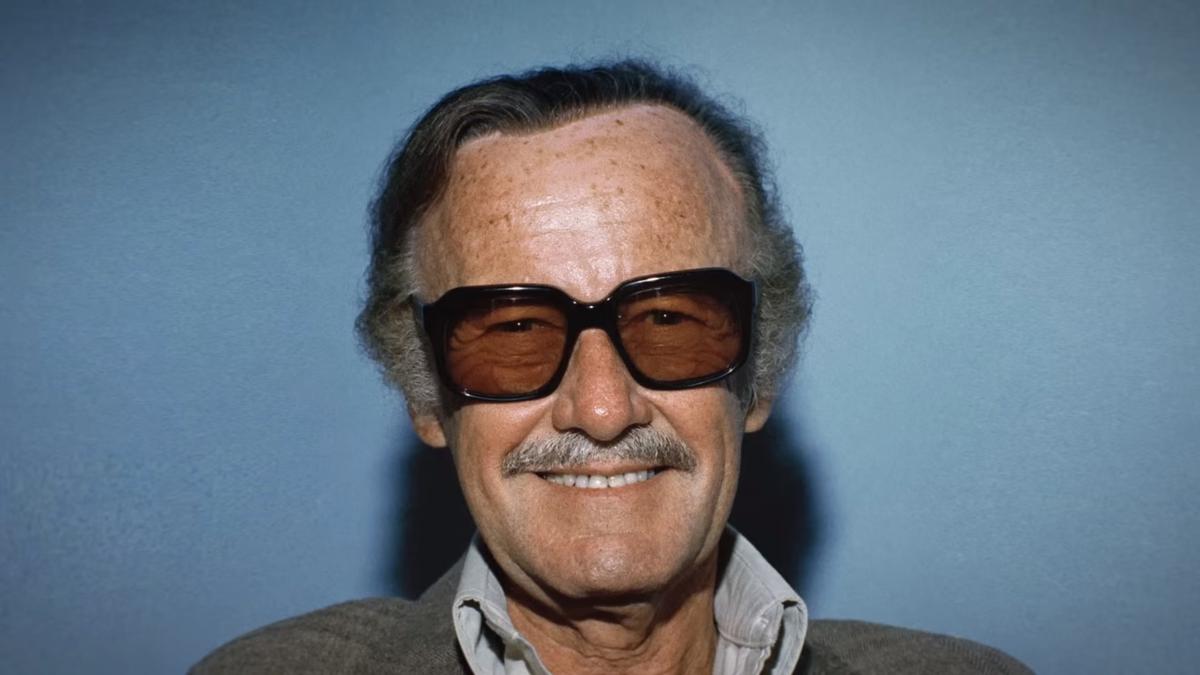

The Avi Arad Pivot

Marvel’s fortunes changed with an unlikely figure: Avi Arad, an Israeli-American toy designer and co-founder of Toy Biz. After Marvel bought a 46% stake in Toy Biz in 1993, Arad became a key player in the company’s operations.

Arad pushed a bold idea, rather than licensing its superheroes to Hollywood for modest returns, Marvel should produce its own films. At the time, Marvel lacked a studio, infrastructure, or capital. The proposal seemed unrealistic. Still, Arad persuaded executives to back a small project.

That project was Blade (1998). Made with a relatively unknown character and modest expectations, the film unexpectedly grossed $131 million worldwide. It restored confidence and opened the door to Marvel’s second act.

The success encouraged Hollywood studios to invest in Marvel properties. X-Men (2000) and Spider-Man (2002) became box-office juggernauts, though the gains went mostly to the studios that held the character rights.

Marvel Studios’ Big Bet

In 2005, Marvel took a transformative gamble; using 10 lesser-known characters as collateral to secure a $525 million loan. The plan was to create its own studio and control its films from script to screen.

The company’s boldest decision came next, casting Robert Downey Jr as Iron Man. Once a promising star, Downey had become notorious because of drug addiction, arrests, and insurance issues. Many studios considered him uninsurable. But Marvel took the risk, and it became the turning point in modern cinema.

When Iron Man premiered in 2008, Downey’s performance electrified audiences. The film earned $585 million globally and ended with a now-legendary post-credits scene featuring Nick Fury proposing the “Avengers Initiative”. It was a declaration of Marvel’s long-term vision, a shared cinematic universe.

What followed was one of the most successful runs in film history: The Avengers, Captain America, Guardians of the Galaxy, Black Panther, Doctor Strange, and the record-shattering Avengers: Endgame. These films redefined blockbuster storytelling and cemented Marvel as a cultural powerhouse.

In 2009, Disney acquired Marvel for $4 billion, a deal widely considered one of the most successful entertainment investments ever made. Marvel’s stock rebounded dramatically over the next decade, and by January 2025 it hit a high of approximately $125 per share. On November 19, it closed at $81.32 on NASDAQ, reflecting ongoing market volatility but continued investor confidence.

November 20, 2025, 20:19 IST