- April 19, 2024

Money Making Tips: All About Compounding And How It Works – News18

Compounding works on the basis of compound interest.

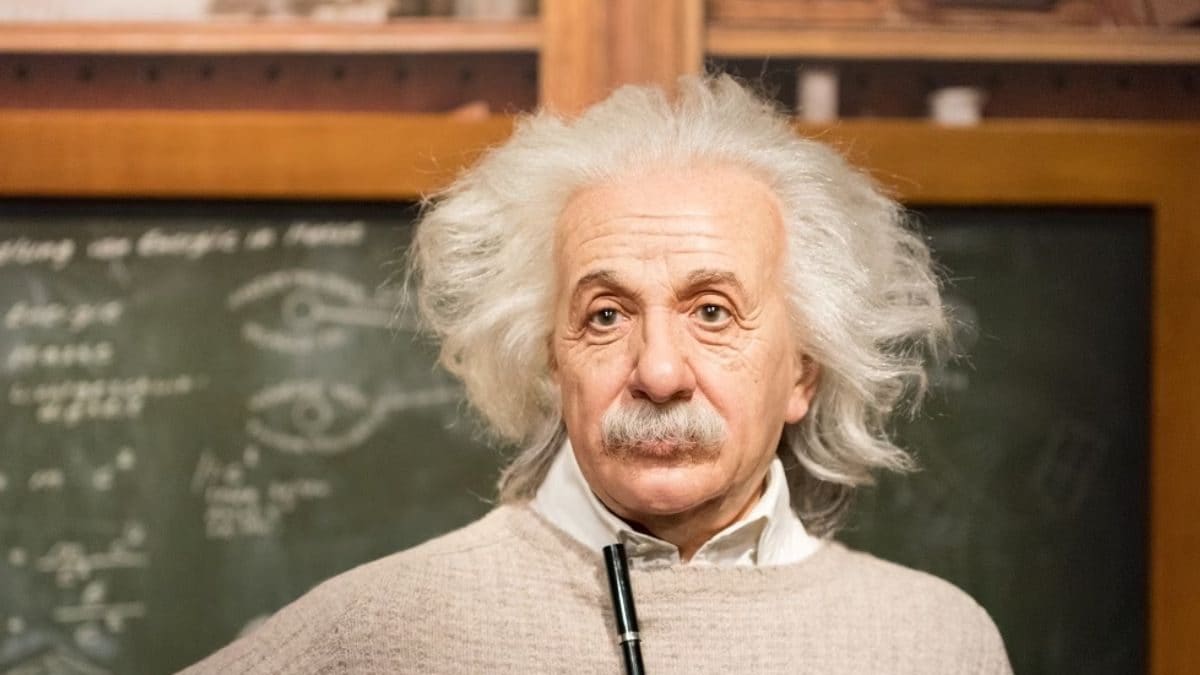

Albert Einstein famously referred to compound interest as the “eighth wonder of the world”.

Earning a good amount of corpus out of a minimum investment is no less than magic. It is possible but is unknown to many people who are new to the investment journey. One such miraculous method of investment works on the principle of compound interest.

Albert Einstein famously referred to compound interest as the “eighth wonder of the world”. He said, “Compound interest is the most powerful force in the universe. He who understands it, earns it; he who doesn’t, pays it.”

Compounding can convert Rs 1 lakh into Rs 1.5 crore within 25 years. Wondering how? To understand this, consider the Aditya Birla Sun Life Flexi Cap Fund which was started in August 1998. Since the start of the fund, it has been giving out an average return value of 21.72 per cent every year. Eventually in 25 years and seven months of span so far, the ones who have invested their money could have now seen it grow manifolds.

What is Compounding?

Compound interent indicates the interest earned on one’s investment which is added to the principal amount every year. As a result of it, you then get interest on that entire amount. In other words, through this, you will not only be earning the interest on your principal balance but make interest on interest earned. Compound interest is when you add the earned interest back into your principal balance, which then earns you even more interest, compounding your returns.

In this way, every year your interest gets added to the principal amount and you then get interest on that entire amount making the invested money huge in the long run. Here is an example of how compounding works-

Let’s say you invest Rs 10,000 in a savings account that offers an annual interest rate of 5%. At the end of the first year, you’ll earn Rs 500 in interest, bringing the total value of your investment to Rs 10,500. Now, in the second year, that Rs 10,500 becomes the new base amount, and you earn 5% interest on that amount, which equals Rs 525. So, at the end of the second year, your investment is now worth Rs 11,025.

Again, the interest earned in each period is added to the initial investment, and in subsequent periods, the interest is earned on both the initial investment and the previously earned interest, resulting in significant growth over time.