- November 24, 2023

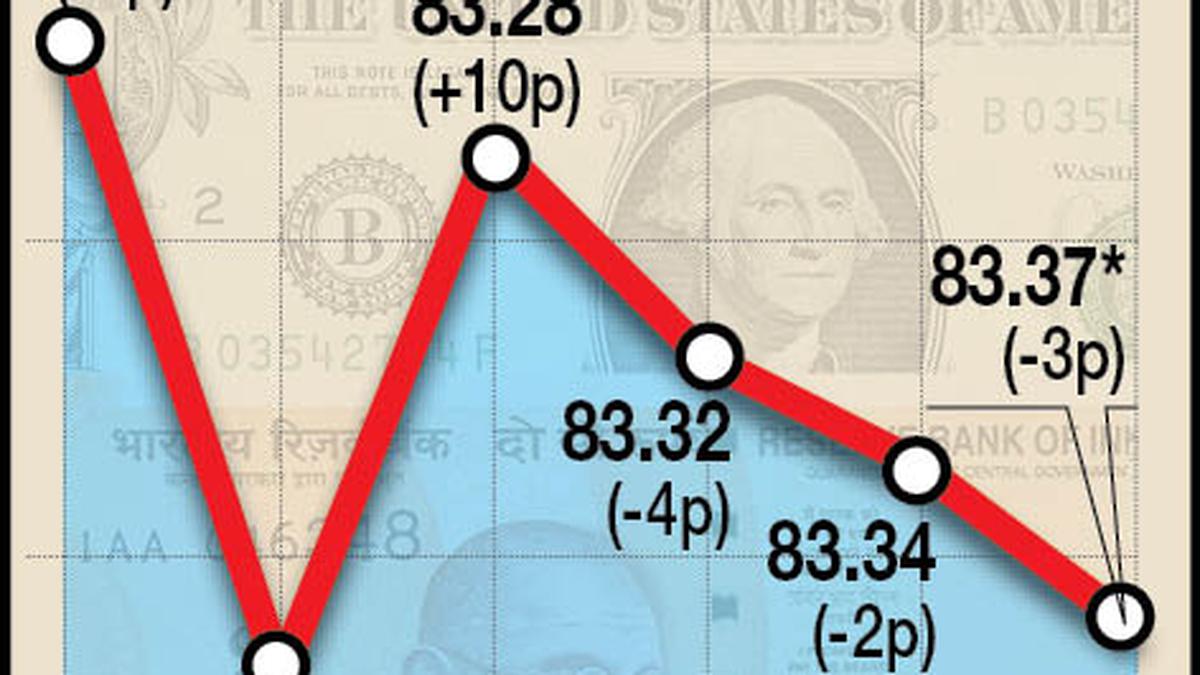

Rupee falls 3 paise to close at 83.37 against U.S. dollar

The rupee edged 3 paise lower to close at 83.37 (provisional) against the U.S. dollar on November 24, tracking higher demand for U.S. dollars from importers and a weak tone among Asian currencies.

Forex traders said a muted trend in domestic equities also weighed on the local unit.

At the interbank foreign exchange market, the local unit opened at 83.33 and touched an all-time low of 83.38 against the greenback.

It finally settled at 83.37 (provisional) against the dollar, registering a fall of 3 paise from its previous close.

On November 23, the rupee settled at 83.34 against the American currency.

The Indian rupee depreciated on November 24 on demand for dollars from importers and weak tone in Asian currencies. However, a softness in the U.S. Dollar and a decline in crude oil prices cushioned the downside, Anuj Choudhary, Research Analyst, Sharekhan by BNP Paribas, said.

“We expect the rupee to trade with a slight negative bias due to weak global markets and expectations of a recovery in the U.S. Dollar index. However, IPO-driven Dollar inflows and a weak tone in crude oil prices may support the local currency.

“Traders may take cues from PMI data out of the U.S. today evening. USDINR spot price is expected to trade in a range of 83.10 to 83.70,” he said.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, was trading 0.18% lower at 103.73.

Brent crude futures, the global oil benchmark, rose 0.28% to $81.65 per barrel.

On the domestic equity market front, Sensex fell 47.77 points, or 0.07%, to settle at 65,970.04 points. The Nifty advanced 7.30 points, or 0.04%, to 19,794.70 points.

Foreign institutional investors were net buyers in the capital market on November 23 as they purchased shares worth ₹255.53 crore, according to exchange data.