- February 17, 2025

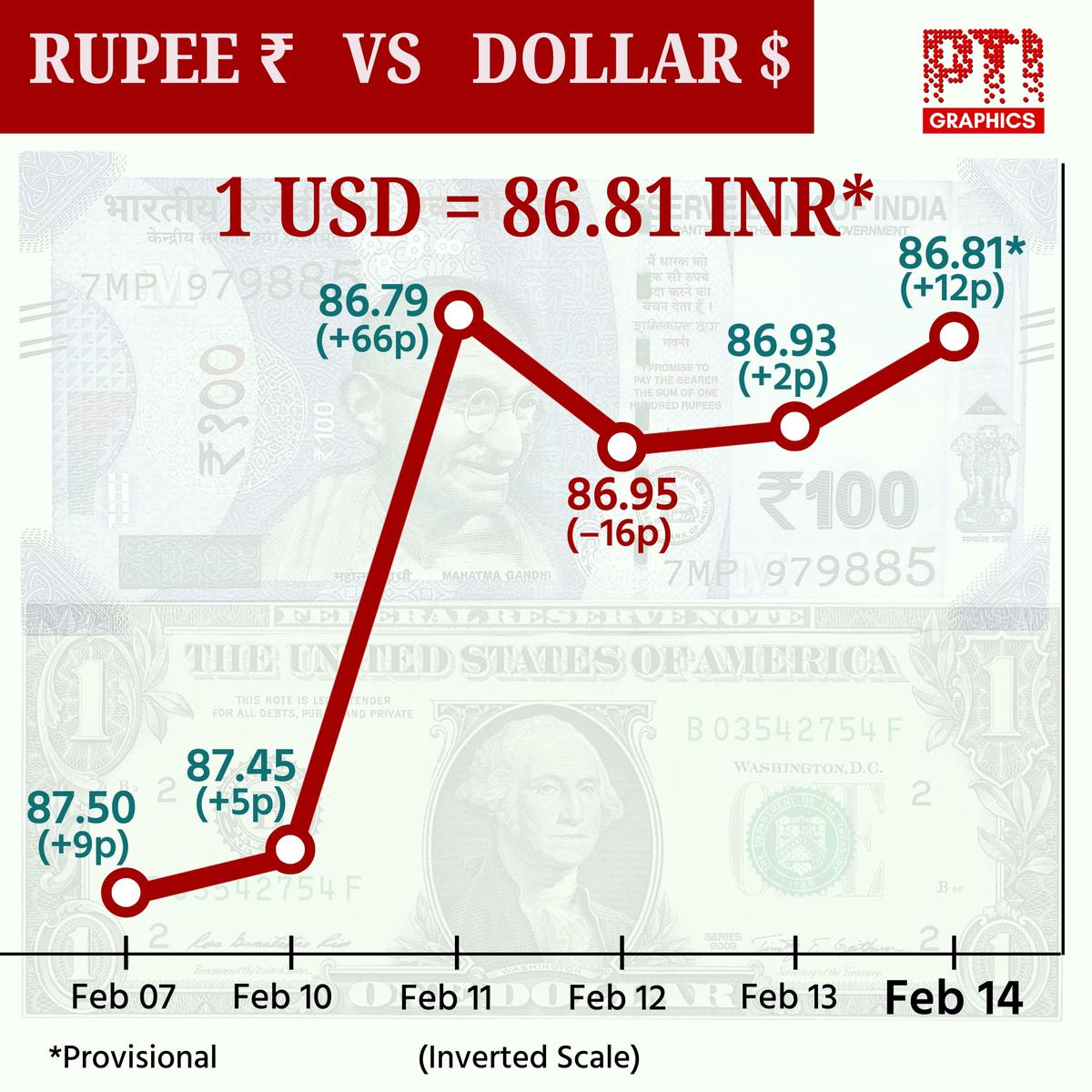

Rupee falls 16 paise to close at 86.87 against U.S. dollar

Traders may take cues from speeches by Federal Open Market Committee (FOMC) members. file

| Photo Credit: Reuters

The rupee depreciated 16 paise to close at 86.87 (provisional) against the U.S. dollar on Monday (February 17, 2025), weighed down by significant foreign fund outflows and a recovery in the U.S. dollar index from intraday lows.

Forex traders said the Indian rupee is trading with a negative bias as foreign banks went on a dollar-buying spree and importers scrambled to secure dollars, as they feared further depreciation amid global uncertainty.

At the interbank foreign exchange, the rupee opened at 86.70 and touched the high of 86.68 against the greenback during intraday. It also touched the low of 86.88 before ending the session at 86.87 (provisional) against the dollar, logging a loss of 16 paise from its previous close.

On Friday (Feb. 14), the rupee extended its recovery and settled 21 paise higher at 86.71 against the U.S. dollar.

“Indian rupee declined today on a weak tone in the domestic markets and a recovery in the U.S. dollar index from intraday lows. However, weak tone in crude oil prices and a decline in U.S. treasury yields cushioned the downside,” said Anuj Choudhary – research analyst at Mirae Asset Sharekhan.

Traders may take cues from speeches by Federal Open Market Committee (FOMC) members.

“We expect the rupee to trade with negative bias amid weakness in the domestic equities and FII outflows. Overall strength in the U.S. dollar may also weigh on the rupee. However, any further decline in the U.S. treasury yields or any further intervention by the RBI may support the rupee at lower levels,” Mr. Choudhary added.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, was trading 0.14% higher at 106.85.

Brent crude, the global oil benchmark, rose 0.12% to $74.83 per barrel in futures trade.

In the domestic equity market, the 30-share BSE Sensex advanced 57.65 points, or 0.08%, to settle at 75,996.86, while the Nifty rose 30.25 points, or 0.13%, to 22,959.50 points.

Foreign institutional investors (FIIs) offloaded equities worth ₹4,294.69 crore in the capital markets on a net basis on Friday (Feb. 14), according to exchange data.

Meanwhile, India’s forex reserves jumped by $7.654 billion to $638.261 billion in the week ended February 7, the RBI said on Friday (Feb. 14).

This is the third consecutive week of a jump in the kitty, which had increased by $1.05 billion to $630.607 billion for the week ended January 31.

Published – February 17, 2025 04:21 pm IST